Dear Valued Customer,

As you know, technology has changed drastically, so updating our system will allow us to provide a smoother, faster experience that’s safe and secure for years to come.

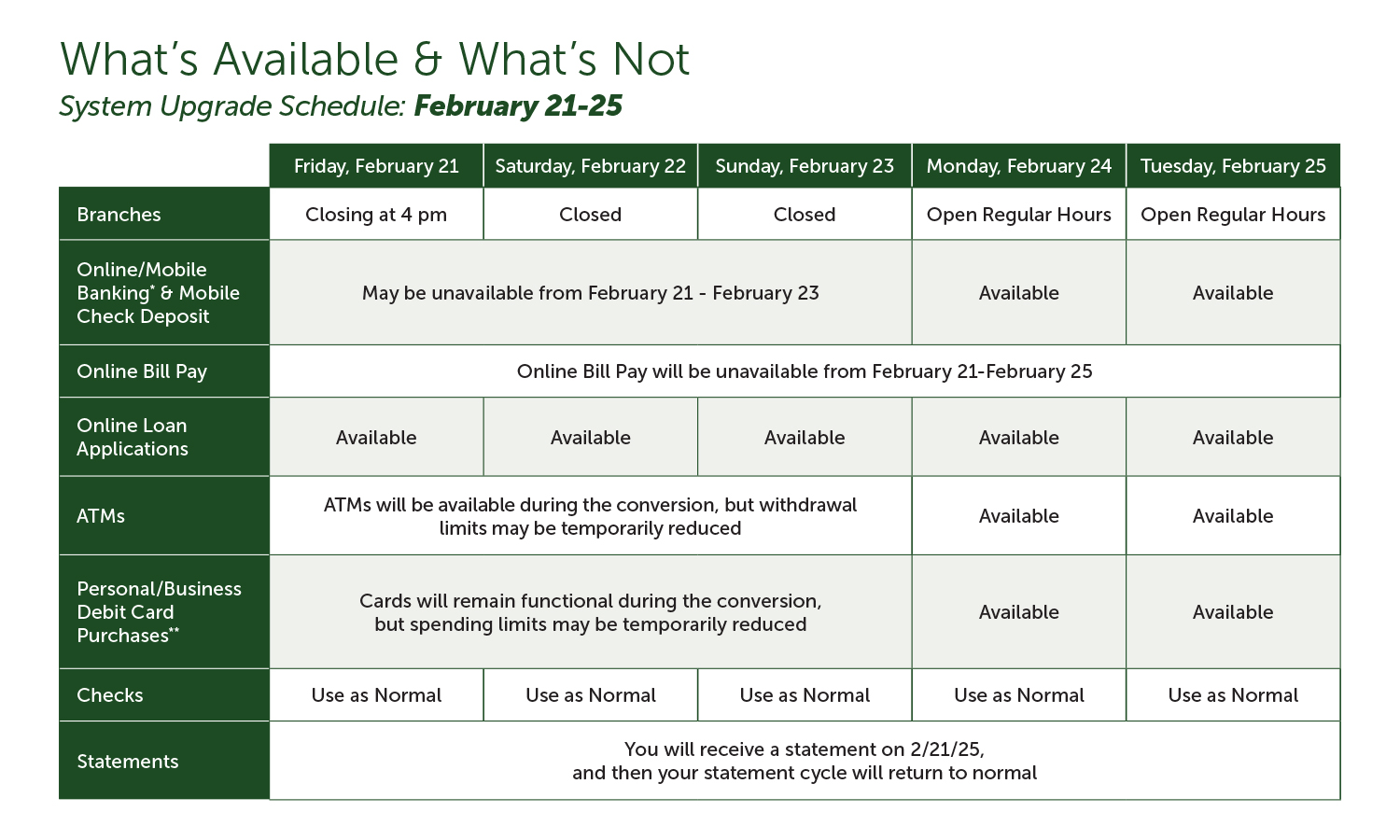

While most of the changes will happen behind the scenes, there will be some brief disruptions on February 21-23, prior to the upgraded system going live on February 24. Our team will work quickly and efficiently so this conversion is as seamless as possible. Please see the chart below for detailed information about what will be available and when.

We apologize in advance for any inconvenience this may cause, and we thank you for your patience.

Once again, thank you for your support and commitment to Regional Missouri Bank. We’re proud to be your bank of choice.

Have questions or concerns?

- Visit your local branch

- Call us toll-free: 1-800-748-7336

- Check this webpage for the most up-to-date details

Accessing your funds during the upgrade:

Please see chart below for more details.

- Debit cards

- Withdraw cash at ATMs

- Use checks

Important Post-Upgrade Details

- Account numbers: Your account numbers will remain the same.

- Debit and ATM cards: Your cards will not change.

- Mobile app:

-

Android Users: Ensure you have Version 12.0 or newer to use the new RMB Mobile app. Please delete the current RMB app and install the new version.

- Apple (iOS) Users: Check for app updates or delete the current RMB app and reinstall the new version.

-

- Usernames and passwords: Your username will remain the same, but you will need to create a new password

- SecurLOCK™: This will be replaced by CardHub, which offers card management and monitoring features with enhanced security. Commercial cards will be unable to use CardHub.

- Checks: You won’t need new checks, and the checks you already wrote will post.

- Online Bill Pay information: Verify your Bill Pay information and payments.

- ACH Deposits: If you are expecting an ACH deposit on 2/24 or 2/25, you may see the credit to your account on 02/21. This early deposit is due to the Core Conversion and will not happen in the future.

System Upgrade FAQ

Why are you upgrading your banking system?

Providing you with the best banking experience possible is important to us, and this upgrade will optimize our security capabilities and enable us to offer more on our mobile app. Plus, this new system is more efficient, so you’ll have a smoother, faster experience.

During the upgrade weekend, will I still be able to access my funds?

Yes, you can continue using your debit card, but some features may be limited.

Can I log in to online or mobile banking?

You likely won’t be able to use online or mobile banking during the upgrade, so please plan accordingly. Our website will still be fully functional throughout the upgrade period, including the ability to apply for loans. Please refer to the schedule below for more details.

Will I need to download my account history to QuickBooks prior the conversion?

Yes, we recommend that you download your account history to QuickBooks before February 21, 2025. Please verify all transactions have been downloaded by reviewing your monthly statements.

- QuickBooks Desktop Conversion Instructions

- QuickBooks Online Conversion Instructions

- Quicken Conversion Instructions

Will I need to re-establish the online payments I have set up through Bill Pay?

No, those will continue to function as usual with no changes.

Will my bank statements change?

No, we don’t expect significant changes to your bank statements. You will receive a statement on February 21, 2025, and then your statement cycle will return to normal.

Will my account and financial information stay secure during this process?

Absolutely. Your security is always our top priority, and your account information will remain protected as we complete this upgrade.

What can I do to prepare?

Please ensure we have the correct mailing address, email and phone number for you. You can contact us or visit your local branch to verify or update your details.

What if the upgrade is delayed or takes longer than expected?

While we don’t anticipate any delays in completing the upgrade, we will post updates on our website and social media pages if the upgrade extends beyond the currently scheduled February 24 completion date.

Please Note: While we aim for accuracy, unexpected delays may occur during our core conversion. We appreciate your patience and understanding.